Have you ever considered reliability and its relationship with your company’s reputation and revenue? I’ll be the first to admit that the Parylene and thin film coatings we manufacture at HZO might not be the hottest topic to discuss at executive networking functions. Still, they enhance electronics, enabling them to survive in extremely harsh environments. And reliability is good economics. Every dependable product you deliver today strengthens your business tomorrow.

Protective coatings, often considered a minor detail in product development or infrastructure planning, are, in fact, critical to long-term performance, financial outcomes, and customer satisfaction. By investing strategically in coating technologies, businesses can significantly reduce warranty claims, extend asset life, improve operational uptime, and strengthen brand reputation. It is time that business leaders reframe protective coatings not as a cost center but as a high-impact lever for business success.

Framing the Challenge: Reliability as a Business Imperative

In nearly every sector, downtime, product failures, and maintenance costs are rising.

The average cost of unplanned downtime across industries is approximately $260,000 per hour (Source).

Equipment failure remains the most common cause of unplanned downtime in manufacturing. With the average manufacturer facing 800 hours of unplanned machine maintenance annually, mechanical issues represent a persistent challenge to manufacturing efficiency (Source).

The annual cost of downtime is now $129 million per facility among Fortune Global 500 companies, up 65% on the last survey in 2019-20 (Source).

Concurrent with rising costs, customers expect longer-lasting, more resilient products. Reliability is no longer just a technical requirement—it’s a competitive differentiator. Neglecting protective coatings can increase lifecycle costs, lost contracts, and reputational damage. The question is not whether you can afford to invest in coatings—it’s whether you can afford not to.

The Value of Protective Coating Technologies

Reliability is like electricity in your home - you don't always notice it when it's there, but the moment it's gone, everything comes to a halt.

Protective coatings guard against corrosion, chemical exposure, weathering, mechanical wear, and strong electrical activity. When applied properly, they form a frontline defense that dramatically increases product durability. Across industries—from automotive to infrastructure to electronics—companies have faced costly setbacks due to coating failures. A proactive strategy around coatings shifts businesses from reactive maintenance to preventative performance assurance.

Reduced Warranty Claims and Service Costs

Warranty claims are expensive and erode customer trust. Parylene and thin film coating systems can dramatically lower the frequency of field failures, reducing the volume and severity of warranty-related costs.

The U.S.-based consumer electronics industry paid $100 million in claims during 2023 (Source).

The U.S.-based semiconductor industry spent a total of $761 million on product warranty claims in 2023 (Source).

The U.S.-based aerospace industry as a whole spent $1.008 billion on warranty claims during calendar 2023 (Source).

Increased Operational Uptime and Asset Utilization

Unplanned downtime can cost companies thousands—sometimes millions—per hour. Coatings that prevent corrosion or surface degradation extend maintenance cycles and allow equipment to operate longer. In industries like energy and manufacturing, where uptime is directly tied to revenue, even marginal improvements in product performance can yield exponential financial returns.

Uptime is directly proportional to production, meaning increased uptime leads to higher production levels (Source).

High uptime reduces the risk of accidents and associated liabilities.

Consistent uptime builds trust with stakeholders, including customers, investors, and regulatory bodies.

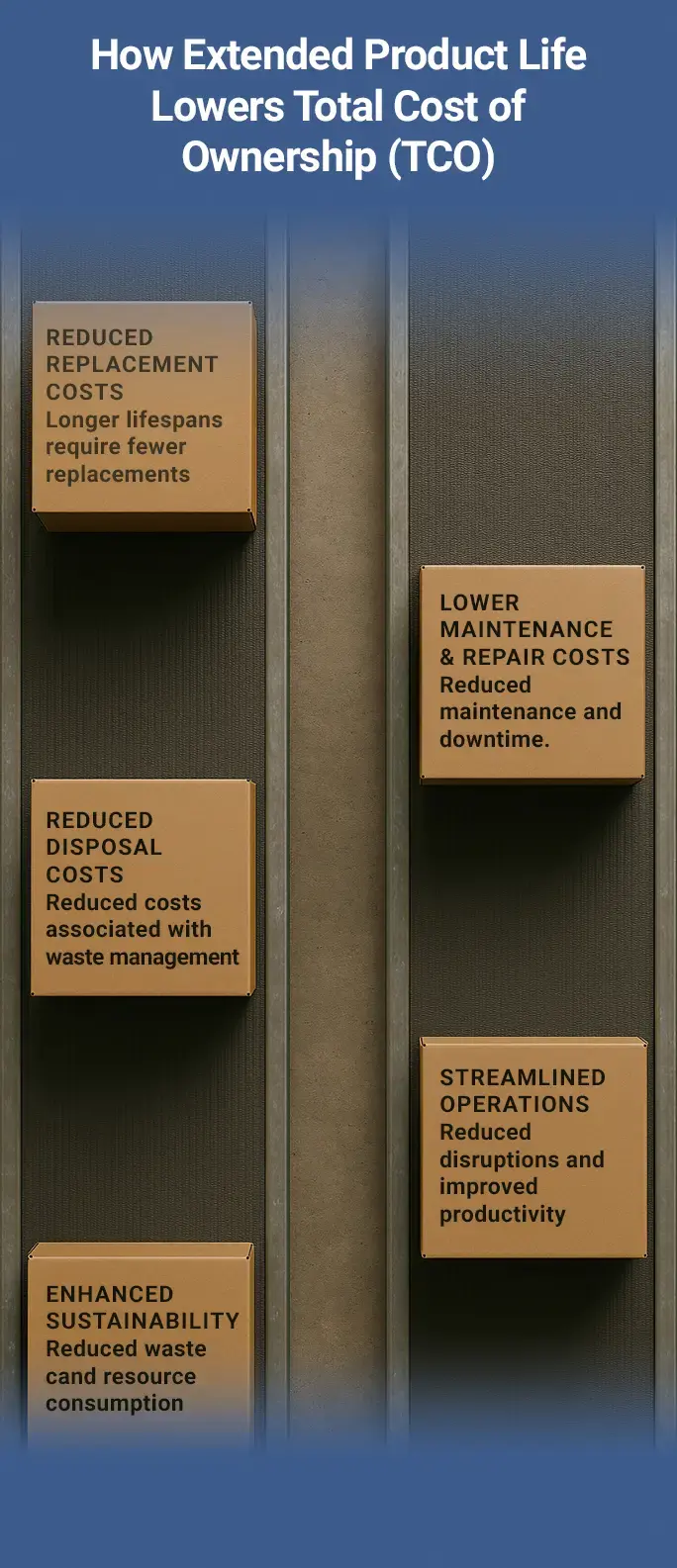

Extended Product Life and Lifecycle Cost Savings

Extending an asset's usable life delays capital expenditures and reduces waste. High-performance coatings contribute to this by mitigating wear and degradation over time. The cumulative impact? Lower total cost of ownership, fewer part replacements, and improved sustainability metrics—all of which are increasingly valued by investors and customers alike.

How Extended Product Life Lowers TCO:

- Reduced replacement costs - longer lifespans require fewer replacements

- Lower maintenance & repair costs - reduced maintenance and downtime

- Reduced disposal costs - reduced costs associated with waste management

- Streamlined operations - reduced disruptions and improved productivity

- Enhanced sustainability - reduced waste and resource consumption

Beyond the Numbers: Strategic Advantages

Reliability isn't just about preventing problems—it's your silent sales engine, quietly turning customer trust into consistent, long-term revenue.

Investing in coatings offers intangible but highly strategic benefits. Products that last longer and fail less frequently are easier to sell. They build customer loyalty. They reinforce your reputation for quality. And in many cases, they help meet environmental and safety regulations. Enhancing components with Parylene and thin film coatings helps companies position themselves not just as manufacturers but as long-term partners.

A selection of HZO Customers

Building the Business Case for Coating Investment

To fully capitalize on coatings, leaders must evaluate more than up-front costs. They need to consider lifecycle cost analysis, historical failure data, and customer feedback. Business leaders collaborate with R&D and product teams to assess where coatings can yield the highest returns. This isn’t just about materials science—it’s about strategic alignment and long-term thinking.

It’s time to lead with reliability. Protective coatings are more than a protective layer; they’re a strategic investment. By prioritizing performance from the surface up, we can reduce costs, improve customer satisfaction, and differentiate our offerings in a crowded market. Reliability isn’t just an engineering metric. It’s a brand promise, and coatings are how we keep it. Contact our team to talk about how we can help your business deliver reliability today.